Term Life Insurance

Term Life Insurance Quote Forms

Looking for coverage? Click any of the following links to submit a quote for quick, accurate and affordable rates.

Term Life Insurance Information

Understanding Term Life Insurance

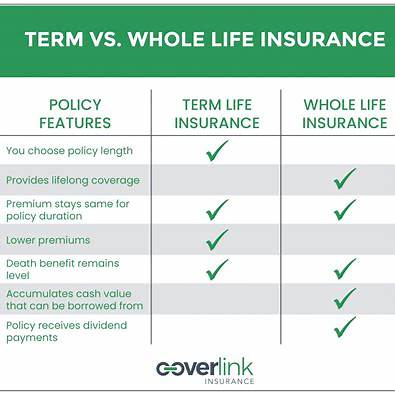

Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. If the policyholder passes away during this term, the beneficiaries receive a death benefit. Unlike permanent life insurance, term policies do not accumulate cash value, making them a more affordable option for many individuals.

Benefits of Term Life Insurance

-

Affordability: Term policies generally have lower premiums compared to permanent life insurance, making them accessible to a broader audience.

-

Flexibility: Policyholders can choose the term length that aligns with their financial obligations, such as the duration of a mortgage or until children reach adulthood.

-

Simplicity: With straightforward terms and conditions, term life insurance is easy to understand and manage.

-

Term Life Insurance in Ohio: Key Statistics

Understanding the landscape of term life insurance in Ohio can help residents make informed decisions.

Life Insurance Ownership in Ohio

As of 2023, approximately 52% of American adults have a life insurance policy. In Ohio, the cumulative value of death benefits for life insurance policies purchased was $107.83 billion, indicating a significant investment by residents in securing their financial futures.

Average Policy Amounts

The average face value of life insurance policies in the U.S. was $160,000 in 2015. While specific data for Ohio isn't provided, this national average offers a benchmark for residents considering coverage amounts.

Cost of Term Life Insurance in Ohio

Premiums for term life insurance vary based on factors such as age, health, and coverage amount. For instance, a healthy 35-year-old male in Ohio might pay approximately $362 annually for a $500,000 policy with a 20-year term, while a 65-year-old male could pay around $6,126 annually for the same coverage.

Factors Influencing Term Life Insurance Rates in Ohio

Several factors can affect the cost of term life insurance premiums:

-

Age: Younger individuals typically enjoy lower premiums.

-

Health: Non-smokers and those without chronic conditions often receive better rates.

-

Coverage Amount: Higher death benefits result in higher premiums.

-

Term Length: Longer terms generally come with increased costs.

Choosing the Right Term Length

Selecting an appropriate term length is crucial. Consider the following:

-

Financial Obligations: Align the term with significant financial responsibilities, such as a mortgage or children's education.

-

Future Income: Ensure the term covers the years your dependents rely on your income.

Top Life Insurance Providers in Ohio

Several reputable companies offer term life insurance in Ohio:

-

Nationwide: Known for a wide range of product types and excellent customer satisfaction.

-

State Farm: Offers a variety of term life options with strong financial ratings.

-

MassMutual: Provides competitive rates and a diverse portfolio of life insurance products.

Ohio-Specific Considerations

When purchasing term life insurance in Ohio, keep the following in mind:

-

State Regulations: The Ohio Department of Insurance oversees life insurance policies, ensuring consumer protection.

-

Conversion Options: Some term policies offer the option to convert to permanent insurance without a medical exam, which can be beneficial as health conditions change.

Common Misconceptions About Term Life Insurance

-

"It's Too Expensive": Many overestimate the cost; term life insurance is often more affordable than expected.

-

"I Don't Need It": Even if you're young and healthy, securing a policy now can lock in lower premiums.

Steps to Obtain Term Life Insurance in Ohio

-

Assess Your Needs: Determine the appropriate coverage amount and term length based on your financial obligations.

-

Compare Quotes: Utilize online tools or consult with agents to compare premiums from different providers.

-

Apply: Complete the application process, which may include a medical exam.

-

Review the Policy: Ensure you understand the terms, conditions, and any riders included.

Conclusion

Term life insurance is a practical and cost-effective way for Ohio residents to protect their loved ones' financial future. By understanding the specifics of term life insurance and considering Ohio-specific factors, you can make an informed decision that aligns with your family's needs.

For more information, consult with a licensed insurance agent in Ohio or visit the Ohio Department of Insurance's website.

|